NOTE: This article was originally posted on March 3, 2019 via Steemit by @chrisrice.

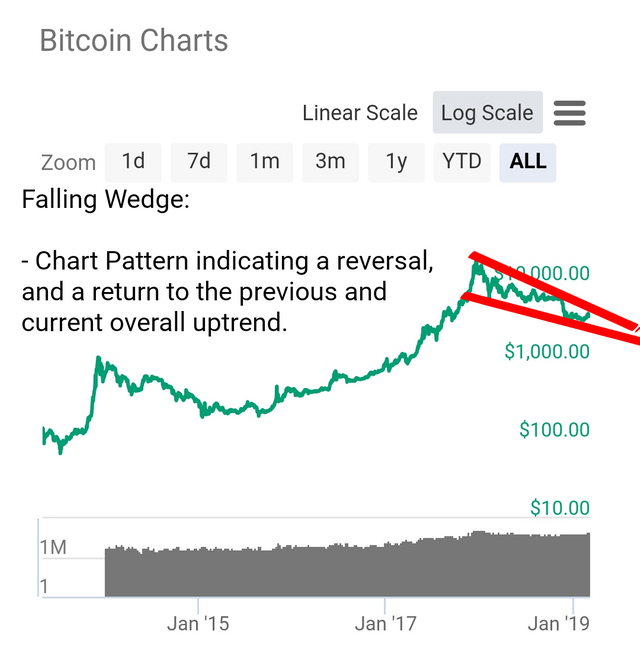

Bitcoin technically entered a Bear Market in February of 2018 after dropping over 20% from it's All-Time High of around $20,000 USD (two months after the initial drop in price), but the overall trend spanning since 2010 may be bullish and might have remained bullish overall this entire time with the recent Bear Market being nothing more than an overly long correction before Bitcoin continues it's overall Bullish and upward trend toward $20,000 USD again and possibly higher.

If that is the case, the overall upward trend in Bitcoin might continue soon, and could cause the price of Steem to increase too (maybe even surge).

Furthermore, if the price of Bitcoin goes above the upper red line on that graph, it might be confirming this theory and could lead to a commencement in Bitcoin's current (or prior) uptrend. It might also lead to a surge in volume.

So the good times for Steemians may be near and right around the corner. This would be especially true for those of us with a stake (i.e. @kenmelendez @freedompoint @tarazkp @galenkp and @gadrian).

If you found this insight newsworthy, please Resteem, Upvote & Share this post. Some of my previous forecasts include predicting that Steem would fall to $0.25 cents before it did, based on a Head & Shoulders chart pattern, and predicting the possibility that Bitcoin could also crash.

In the case of this possible forecast, the chart is showing a Falling Wedge which could indicate that the prior and current overall trend is still up, with the commencement of the uptrend right around the corner and possibly at the door.

Nothing is guaranteed though. This isn't financial or profession advice of any kind. It is only an idea and a possibility, not necessarily true but time will tell.

P.S: @exyle also shared some technical analysis on his Steemit blog and this idea of Bitcoin being in an overall upward trend since 2010 could and possibly should be shared by people like @aggroed @theycallmedan, @surpassinggoogle and @nathanmars.

0 comments:

Post a Comment